QuickBooks offers features such as inventory tracking, invoicing, bank transaction management, and financial reporting. Additionally, QuickBooks has a vast community of users who share their experiences, insights, and knowledge through online forums and support groups. Financial statements such as balance sheets, trial balances, and profit/loss statements are crucial documents for running a business smoothly. A bookkeeping expert can create and archive these records, making them easily accessible for examination and use. These statements are significant for tax rebates and can also facilitate funding by providing necessary financial records. Yearly financial statements are essential for business owners, and bookkeeping experts play a vital role in ensuring their accuracy and usefulness.

How to find an accounting virtual assistant: Key considerations and best practices

Virtual bookkeepers perform these tasks remotely, offering a flexible and cost-effective solution for businesses of all sizes. They can also provide guidance on tax-related issues, ensure that all financial transactions are recorded accurately, and help businesses track their expenses and income. A bookkeeping virtual assistant can streamline your financial record-keeping, manage accounts payable and receivable, reconcile bank statements, and generate financial reports. By freeing up your time to focus on core business activities, a bookkeeping virtual assistant can help you maintain accurate financial records and make informed decisions.

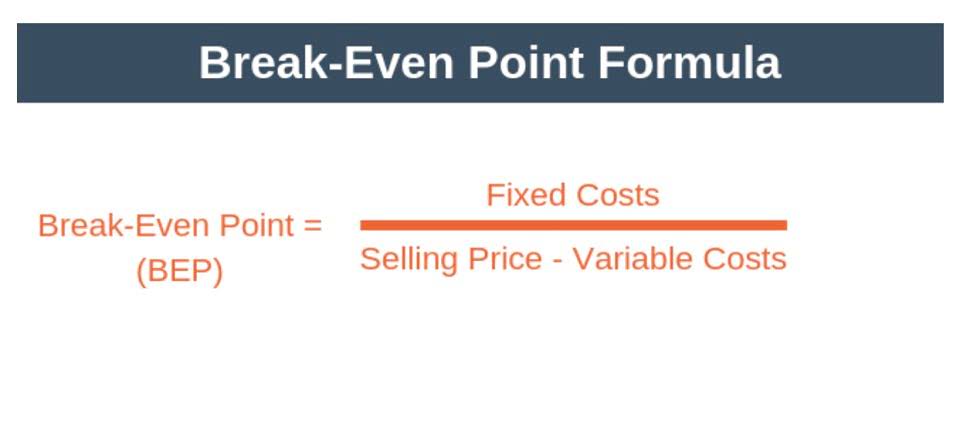

Saves money

They offer an extra hand with organizing files, making calls, and other simple administrative tasks. Receivables are essential, especially when the business thrives on customer’s payments. Some bookkeeping experts also recommend changes you should make to increase the firm’s profit. Most VAs charge only based on the number of hours they work and not a fixed salary. There’s no denying that managing small business finance can be either too tedious or too complex to understand. Our team guides you through every step of the valuing inventory process—as you onboard and beyond.

Virtudesk, a leading business service provider, is your one-stop shop for handling the rest while you scale your success. You don’t have to worry about the inconveniences of software nor the expenses of hiring a full-time present value of future cash flows accountant. Your next concern could be how to manage the productivity of the virtual bookkeeper. If you are looking for a virtual bookkeeper who will do more than just bookkeeping, you should check out 24/7 Virtual Assistant. Virtual accountants trained in tax preparation can keep you updated about the taxes you’ll have to pay by organizing them quarterly or annually. They manage your business finance, remind you to pay bills, help you calculate tax, and manage money.

Fully Managed Onboarding & Support

Consequently, making sure you always adhere to both internal and external financial policies is essential. One of the best skills to have on your side as a virtual bookkeeper is the ability to communicate effectively. Working in an accounts department, you will regularly be communicating with all the other teams in the business. This means that you will be dealing with a wide range of people in different roles. Different virtual bookkeeping assistants specialize in various areas of bookkeeping.

BELAY’s AI-Empower Professionals:Where Human-Driven Solutions Meet AI-Enabled Efficiencies

- One of the most valuable tasks a bookkeeping virtual assistant can undertake is helping to generate detailed financial reports.

- Let our trained assistants handle your bookkeeping, from maintaining ledgers to verifying data and preparing financial reports.

- See how connecting with experts one-on-one gives this busy voice-over artist the confidence her books are done right and frees up time for the things she loves to do.

- Moreover, bookkeeping VAs can assist with tax and regulatory compliance, ensuring accuracy and mitigating potential penalties.

Let’s have a look at why you should give virtual assistant bookkeeping services a shot. A Live bookkeeper cannot begin cleaning up your past books until they receive the required supporting documentation, which your bookkeeper will request from you after your first meeting. Once your bookkeeper receives all the necessary documentation, they’ll typically complete your cleanup within 30 days.

In some cases, your cleanup may take longer depending on timeliness of documentation and the complexity of your books. Interested in discovering more about how outsourcing bookkeeping can streamline your financial management? Download our eBook managing sales tax to uncover the numerous benefits of hiring an assistant to help with bookkeeping. You can schedule your bookkeeper’s hours according to the work you need them to do.

Finances can only be managed by systematic, organized tracking of inflow and outflow of money. Unlike accounting, which can be done by anyone, many business tasks like client meetings and product marketing, require your input. By spending a lot of time handling finances, you won’t have time to focus on growing your business — which can cost a lot of money in the long run. If you invoke the guarantee, QuickBooks will conduct a full n evaluation of the Live Bookkeeper’s work.