Paying home loan attract could possibly get decrease your nonexempt income

Michelle P. Scott are a vermont lawyer with detailed expertise in income tax, corporate, economic, and you can nonprofit laws, and you can personal policy. Because the Standard The advice, private specialist, and Congressional guidance, this lady has informed creditors, organizations, causes, people, and you will societal authorities, and created and lectured widely.

Purchasing your own house boasts specific nice taxation benefits. The home mortgage attention taxation deduction is one of her or him. The fresh Taxation Incisions and you may Efforts Operate (TCJA) impacted it deduction some whether it went to your effect inside the 2018, nonetheless it don’t get rid of the deduction in the taxation password. It really put certain restrictions and you may limitations.

How to ?Claim Home loan Appeal in your Taxation Return

?You ought to itemize your income tax write-offs to the Schedule Good out of Means 1040 so you’re able to claim financial attention. That means forgoing the standard deduction to suit your submitting reputation. You might itemize, you can also allege the quality deduction, you can’t manage both.

Enter the mortgage attract will cost you toward lines 8 as a result of 8c from Agenda Good, following transfer the out-of Agenda An inside line 12 of the fresh new 2021 Function 1040.

Choosing How much cash Notice You Paid back on your own Mortgage

You need to found Form 1098, the mortgage Interest Report, from your mortgage lender following the romantic of income tax year, generally speaking in the January. This form records the full interest you reduced within the prior season if it is higher than $600.

You don’t have to install the shape on tax go back, since financial institution should also post a duplicate away from Setting 1098 on Irs, so that the Irs currently enjoys a duplicate.

Make sure the home loan appeal deduction your claim to the Schedule A matches the amount that is claimed toward Form 1098. Extent you could subtract will be below the complete number that appears toward means, based on certain constraints.

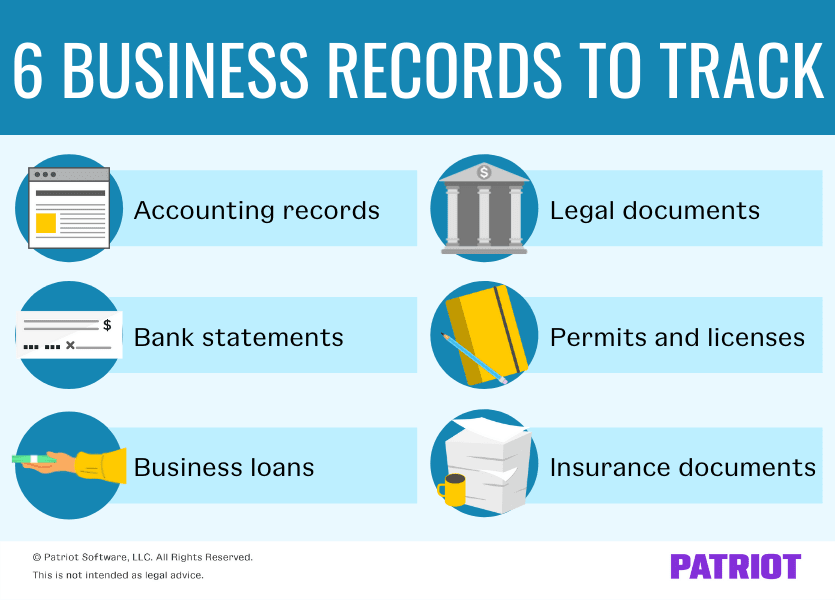

Keep Function 1098 ?which have a copy of filed taxation get back for around three years. Remaining copies of recorded returns can assist when you look at the preparing coming taxation statements.

Is the Deduction Worth Stating?

Plan A discusses a great many other allowable itemized expenses also, plus real-estate taxation, medical expenses, and you can charitable benefits. ?Sometimes each one of these total up to over the product quality deduction for your filing updates, so it is really worth the time and effort to itemize their write-offs, however, sometimes they usually do not.

It www.availableloan.net/installment-loans-wi/kingston/ could be smart to miss the mortgage attract deduction and you can allege the quality deduction should your total of all of the their itemized deductions doesn’t meet or exceed the amount of the quality deduction you’re permitted. Basic deduction costs are as follows:

- Solitary taxpayers and you may partnered taxpayers which document , $12,950 to have taxation season 2022

- Married taxpayers just who document jointly and also for being qualified widow(er)s: $twenty five,a hundred to own taxation year 2021, $twenty five,900 getting income tax year 2022

- Heads away from domestic: $18,800 having income tax season 2021, $19,400 to have 2022

It could be wise to done Plan Good and you can evaluate brand new total of your own itemized deductions with your simple deduction locate aside hence experience right for you before filing your own return.

Do-all Mortgages Be eligible for This Tax Deduction?

This consists of focus you reduced on the financing to get a property, family guarantee personal lines of credit (HELOCs), and also build fund. Nevertheless TCJA put a critical limitation towards house equity loans you start with new 2018 tax year. You simply can’t claim new deduction for this form of loan except if you could confirm it absolutely was removed so you’re able to «purchase, generate, otherwise dramatically increase» the home you to secures the borrowed funds. You simply cannot claim brand new taxation deduction for people who refinance to spend for a college education otherwise relationship, sometimes.