You might close on the mortgage the moment framework is finished and you will a certification out of Occupancy might have been awarded. Hopeless homebuyers was indeed recognized to get money up until the fundamentals is also poured. There is nothing wrong with a bit of hands-on considered, however, remember that our longest rates secure months is actually 75 days from closure. For individuals who exceed that it timeframe, there isn’t any make sure you’ll contain the financial and you can interest rate you desired. It doesn’t matter, we have been usually happy to advise you if you want to initiate new conversation ahead of time.

A certification of Occupancy (CO) is an official file saying that property enjoys done build according to most of the related strengthening and protection rules. COs are expected from the most local governing bodies before you could is actually lawfully permitted to move around in and a mortgage lender to close on your own the structure financing. They’re usually performed of the a city inspector after a comprehensive walkthrough of the house. Should your household will not solution the new review, you’ll likely has a window of your energy to correct the newest an excellent circumstances.

eight. Is it necessary to utilize the builder’s bank?

For individuals who only take some thing of this post, allow it to be this: You don’t need to to make use of the fresh builder’s common bank. New creator may make it appear to be you must fool around with its well-known bank, you will have the choice to invest in your house with others. Just remember that , builders are usually all over the country organizations and it is you can its prominent bank is actually the main same business loved ones. It has been about builder’s welfare about how to partner and their well-known bank, but it may possibly not be into the your. For many who research rates, you’ll likely find a very competitive financing that fits your aims and needs.

8. What if you are provided financial bonuses to make use of the fresh new builder’s popular financial?

It is not strange to own designers so you’re able to attract your for the that have economic incentives which you can lose if you choose to loans your house with anyone other than its well-known financial. Term to your wise: This type of incentives are oftentimes much more attractive the theory is that than simply it are in routine. Such as for instance, brand new builder can offer a great seller’s borrowing from the bank significantly higher than what you would generally score that have a classic lender-will well over $ten,000. not, they are able to and struck your that have excessive financial costs one to effectively negate the new seller’s borrowing entirely. Following, they may tack with the a top rate of interest forever size. If it seems too good to be real, they most likely try.

nine. What’s the builder’s financial trap?

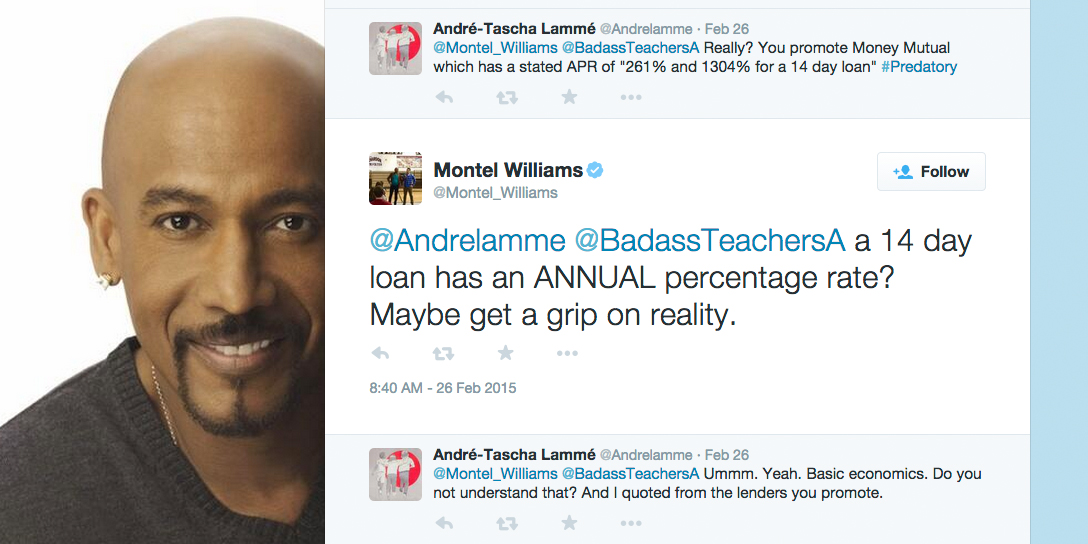

Developers have also known to use predatory financing plans one generally cause you to manage their common financial. Such as, certain developers will demand you to definitely expose an effective «connection letter» from your financial one promises investment doing per year during the get better regarding closing. The fresh creator are completely aware you to no lender (apart from their particular) commonly invest in these types of conditions, leaving the latest homebuyer no alternative but to choose the testimonial. If you’re ever served with a situation such as this, we are able to help you performs to it. However, it should probably be drawn because a warning sign your creator is wanting to ripoff you.

It could be near impossible to score a builder in order to move for the listed price of a different sort of structure house. payday loan Malcolm Yet not, that does not mean that you should not is actually-also it obviously does not always mean that you must get off the new discussion table empty-handed. The next best place to begin with is found on enhancements. A builder may be unwilling to hit as low as $1,one hundred thousand away from their residence’s price, however, that same builder tends to be happy to throw-in $ten,one hundred thousand worth of enhancements using their showroom. When you find yourself provided improvements throughout the negotiation procedure, the pros suggest deciding on the types of has that may put genuine really worth to your house, instance wood floors or marble counter tops.