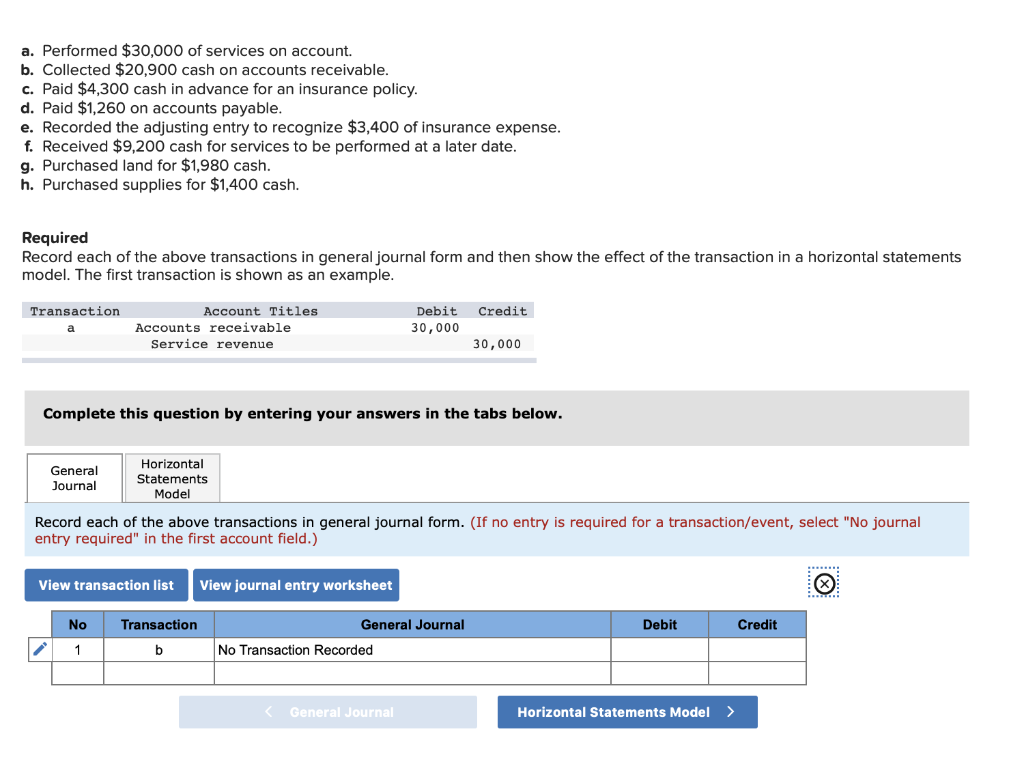

Colorado Customers. Upon bill out of a genuine consult, a good CRA will divulge to you personally in writing the name away from each person requesting borrowing from the bank information regarding your for the 6 months preceding the brand new date of every consult. Immediately following one reinvestigation, CRAs will send authored find to each and every person to who erroneous guidance could have been supplied over loans Stratmoor CO the last half a year. CRAs ought to provide created notice regarding reinsertion of data.

You’ve got a straight to place a beneficial «coverage frost» on your own credit report pursuant so you’re able to nine V

In the Tx, you are able to promote an activity to enforce a beneficial CRA’s loans for the people court or, in the event that consented because of the both parties, by submitting new argument in order to binding arbitration. Читать далее