Thus, if you would like an extra mortgage, be certain that you’re personal debt-clear of early in the day borrowings

Immediately when we imagine otherwise speak about money, finances, mortgage loans, property, financial investments, otherwise loans financing management instantly enters the image. Monetary planning is an easy analysis of income, expenditures, and you can discounts. Should it be a nation, providers, business, otherwise house, wisdom and you can dealing with money are going to be stressful. Proper monetary think just secures your existing financial status but together with assurances your upcoming as well. Tight economic believed results in a systematic monetary lifetime.

That have enough think on finances, you can achieve the long and short-term specifications conveniently. But occasionally a guy may require more loans. The necessity regarding financing can even be a surprise into the an individual’s life. There are various possibilities in the industry by which that could possibly get fulfil his/the girl element loans and bringing a personal bank loan is just one of them. Appropriate economic think with a continuous mortgage is quite crucial since the lifestyle rotate doing loans.

Not only will this help you without difficulty carry out any expenditures, deals, and financial investments but also pay off the debt punctually versus even more desire and you can charge. Below are given several simple resources which can help you to manage your financing without difficulty even though you has an ongoing mortgage:

Following the a lot more than-provided resources allows you to do funds in ways in order to manage timely money, keep costs down, and keep proper credit score

- Would your debt-to-income Proportion

Once you get a personal bank loan, the lending company otherwise monetary institution closely inspections your debt-to-income proportion. To test their using capability, the company often separate all month-to-month financial obligation repayments by your month-to-month earnings. If at all possible, your own front-avoid proportion really should not be more twenty-eight percent, in addition to straight back-avoid proportion will likely be 36 per cent otherwise quicker together with the your expenditures. By this, your paying back potential is hoping. To possess keeping a low financial obligation-to-money ratio, you should take control of your expenses. Whether your expenditures is planned, you are able on precisely how to pay-all their owed instalments punctually.

Pursuing the a lot more than-given tips will allow you to would funds in ways to handle prompt money, keep your charges down, and continue maintaining an excellent credit rating

- Paying off Large-rates Debts

Past high-costs expenses are definitely the actual reason economic believed fails which have the new constant loan. It is essential to to blow all of the such as for instance earlier large-cost debts ahead of opting for a new mortgage. Loan buildup does not only trigger tiring financial items but may manage a large disease if you don’t addressed properly.

Adopting the more than-offered resources will allow you to manage earnings in a sense in order to handle quick repayments, reduce costs, and keep a healthier credit history

- Raise Deals as a result of Short Repayment Arrangements

Currently, there are a lot of on the web websites or other sites offering your different kinds of repayment segments but you will be decide just to possess such a plan which will leave you obtain the most. For those who control your funds well, you can pay off the private loan amount much sooner than the fresh booked big date. This will plus save some extra number that will features been energized while the a destination. Settlement of finance before go out also speeds up rescuing and cost ability.

Adopting the significantly more than-considering resources allows you to manage cash you might say to help you handle fast repayments, keep costs down, and sustain a healthier credit history

- Keep an eye on Earnings, Savings, and you may Expenditures

Financial overseeing is a continuous process. Spending occasionally can certainly cross your financial allowance restriction actually before you know it. Evaluating their expenses is the greatest way to avoid so many disbursement. It has been suggested to jot down any expenses beforehand which means you get focus on things with regards to the standards, especially if you keeps a continuing unsecured loan. This is very of use if you’re a small rigorous to your finances in any times and also to spend all of your debts towards the an urgent foundation.

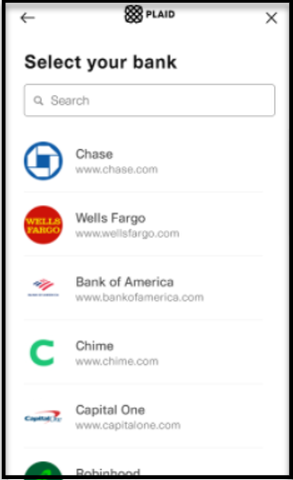

Make sure to purely follow whatever you provides prepared. Overseeing should be done within normal periods of energy in order for if there’s any improvement in your earnings otherwise expenses, it may be handled effortlessly with no hustle. You might use different cellular otherwise computer system programs to find and you can scan your income and you can expenditures with your lower costs and you may offers.

Following the significantly more than-considering info will help you to carry out money in a way to help you manage punctual repayments, keep costs down, and maintain a healthier credit history

- Manage Punctual Payments

You need to be most disciplined if you need to spend from your constant mortgage as fast as possible. Not just quick fees will assist you to replace your economic reputation however it will even enhance your deals. And you will rescuing much more about often increase installment long rerm loans no credit check Central TN the consumer loan installment capability and this method you could potentially take control of your earnings well if you find yourself paying off any dues.

An unsecured loan is unsecured borrowing from the bank. Although bank/NBFC does not ask for equity, its vital to pay the EMIs on time.